The Pakistan Stock Exchange (PSX) surged to an all-time high on Friday, driven by parliamentary approval of the FY2025–26 federal budget and renewed US-Pakistan trade talks, boosting investor confidence.

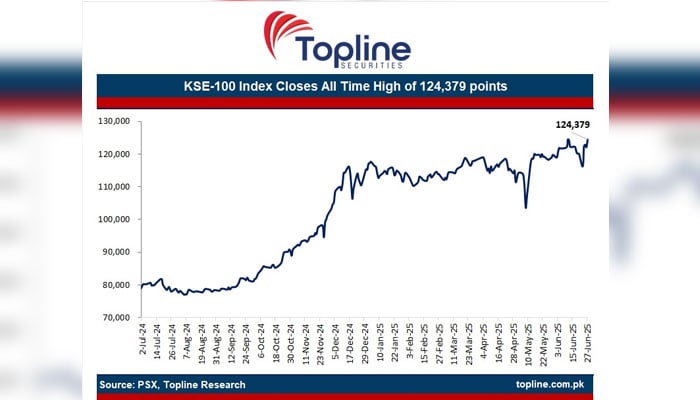

KSE-100 Index Hits Historic Peak

The KSE-100 Index closed at 124,379.06, gaining 2,332.60 points or 1.91% from its previous close of 122,046.46, marking a record high for the Pakistan Stock Exchange (PSX). The index reached an intraday peak of 125,285.05, with trading volumes remaining strong at 220,312,628 shares exchanged. The rally reflects optimism fueled by the National Assembly’s approval of the Rs17.57 trillion federal budget for FY2025–26 and positive developments in US-Pakistan trade relations.

Independent analyst AAH Soomro attributed the surge to renewed bilateral ties and a macroeconomic rerating, noting that stock valuations are attractive compared to fixed-income alternatives. The market’s bullish sentiment was further supported by robust inflows through the Roshan Digital Account (RDA), which recorded $10.38 billion from September 2020 to May 2025, with $201 million in May alone, a 13% month-on-month increase. According to Saad Hanif of Ismail Iqbal Securities, $6.65 billion of RDA funds have been invested locally, primarily in Naya Pakistan Certificates and Roshan Equity.

Budget FY2025–26 Key Highlights

The National Assembly approved the federal budget on Thursday, incorporating amendments to the Finance Bill 2026 presented by Finance Minister Muhammad Aurangzeb. Key revisions include updates to the Sales Tax Act, empowering the finance committee to authorize arrests for tax fraud exceeding Rs50 million. The income tax structure for salaried individuals was also revised: incomes up to Rs600,000 remain tax-exempt, while those between Rs600,000 and Rs1.2 million face a 1% tax rate, with fixed slabs for higher brackets up to Rs346,000 for incomes between Rs3.2 million and Rs4.1 million.

The budget’s fiscal consolidation measures, including a projected 3.9% fiscal deficit, have been well-received by investors, signaling economic stability. The absence of aggressive new taxes on equities further bolstered market sentiment, as noted by analysts.

US-Pakistan Trade Talks Boost Sentiment

Investor confidence was also lifted by progress in US-Pakistan trade negotiations. Following a virtual meeting on Tuesday between Finance Minister Aurangzeb and US Commerce Secretary Howard Lutnick, both sides expressed optimism about concluding talks soon, potentially leading to a Preferential Trade Agreement (PTA) or Bilateral Trade Agreement (BTA). These discussions, intensified after Field Marshal Asim Munir’s recent US visit, aim to enhance reciprocal market access and strengthen bilateral trade. Posts on X highlighted the urgency of concluding these talks ahead of a looming July tariff deadline, with Pakistan facing a 29% tariff on exports to the US under proposed measures targeting countries with trade surpluses.

Market Context and Outlook

The PSX’s record-breaking performance follows a volatile week, with the KSE-100 dropping 715.18 points on Thursday after hitting an intraday high of 123,417.87. Despite occasional pullbacks, the index has gained 3.14% over the past month and 55.42% year-on-year, reflecting strong market resilience. Analysts attribute the sustained rally to positive macroeconomic indicators, including a 23% reduction in the trade deficit, a 3.5% CPI-based inflation rate, and record remittance inflows of $3.7 billion in May. However, geopolitical tensions and profit-taking in heavyweight sectors could introduce volatility, as seen in recent sessions.